des moines new mexico sales tax rate

700 Is this data incorrect Download all Iowa sales tax rates by zip code. This rate includes any state county city and local sales taxes.

Washington Sales Tax Rates By City County 2022

The Iowa state sales tax rate is currently.

. The 7 sales tax rate in Des Moines consists of 6 Iowa state sales tax and 1 Polk County sales tax. The Des Moines County Iowa sales tax is 700 consisting. How Does Sales Tax in Des Moines compare to the rest of Iowa.

New Mexicos sales tax rates for commonly exempted categories are listed. The latest sales tax rate for Des Moines County IA. The minimum combined 2022 sales tax rate for West Des Moines Iowa is.

The minimum combined 2022 sales tax rate for Des Moines County Iowa is. Cities or towns marked with an have a local city-level sales tax. This includes the sales tax rates on the state county city and special levels.

Some cities and local governments in Des Moines County collect. Wayfair Inc affect Washington. This is the total of state and county sales tax rates.

The state sales tax rate in New Mexico is 51250. The New Mexico state sales tax rate is 513 and the average NM sales tax after local surtaxes is 735. Last year the average property taxes paid was 06 Des Moines New Mexico.

The Iowa sales tax rate is currently. Ad Find Out Sales Tax Rates For Free. The Des Moines Washington sales tax is 1000 consisting of 650 Washington state sales tax and 350 Des Moines local sales taxesThe local sales tax consists of a 350 city sales tax.

Des Moines in Washington has a tax rate of 10 for 2021 this includes the Washington Sales Tax Rate of 65 and Local Sales Tax Rates in Des Moines totaling 35. New Mexico NM Sales Tax Rates by City. The sales tax rate in Des Moines New Mexico is 78.

The latest sales tax rate for Des Moines IA. The average cumulative sales tax rate in Des Moines New Mexico is 606. The Des Moines New Mexico sales tax is 513.

The current total local sales tax rate in Des Moines WA is 10100. This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax.

Are charged at a higher sales tax rate than general purchases. While many other states allow counties and other localities to collect a. You can find more tax rates and allowances for Des Moines and Iowa in the 2022 Iowa Tax Tables.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The Des Moines New Mexico sales tax rate of 60625 applies in the zip code 88418. This is the total of state county and city sales tax rates.

With local taxes the total sales tax rate is between 51250 and 92500. The Des Moines sales tax rate is. An alternative sales tax rate of 775 applies in the tax region Des Moines which appertains to zip.

New Avalara Tax Changes 2022. The 7 sales tax rate in West Des Moines consists of 6 Iowa state sales tax and 1 Polk County sales tax. Browse New Mexico CPA Firms.

The Des Moines New Mexico sales tax rate of 60625 applies in the zip code 88418. In almost every case the person engaged in business passes the tax to the consumer either separately stated or as part of the selling price. The 2018 United States Supreme Court decision in South.

The December 2020 total local sales tax rate was 10000. 600 Is this data incorrect The Des Moines Iowa sales tax is 600 the same as the Iowa state sales tax. Very Important Map Shows Where Majority Of America S Pizza Is.

Puerto Rico has a 105 sales tax and Des Moines County collects an. Only in its effect on the buyer. New Mexico City and Locality Sales Taxes.

Des Moines is located within Union. This rate includes any state county city and local sales taxes. Groceries are exempt from the New Mexico sales tax.

A county-wide sales tax rate of 1 is applicable to localities in Des Moines County in addition to the 6 Iowa sales tax. There is no applicable city tax or special tax. Here is the table with the State Income Taxes in the.

You can print a 7 sales tax table here. Fast Easy Tax Solutions. Did South Dakota v.

Counties and cities can charge. 2020 rates included for use while preparing your income tax deduction.

Missouri Sales Tax Rates By City County 2022

New Mexico Sales Tax Rates By City County 2022

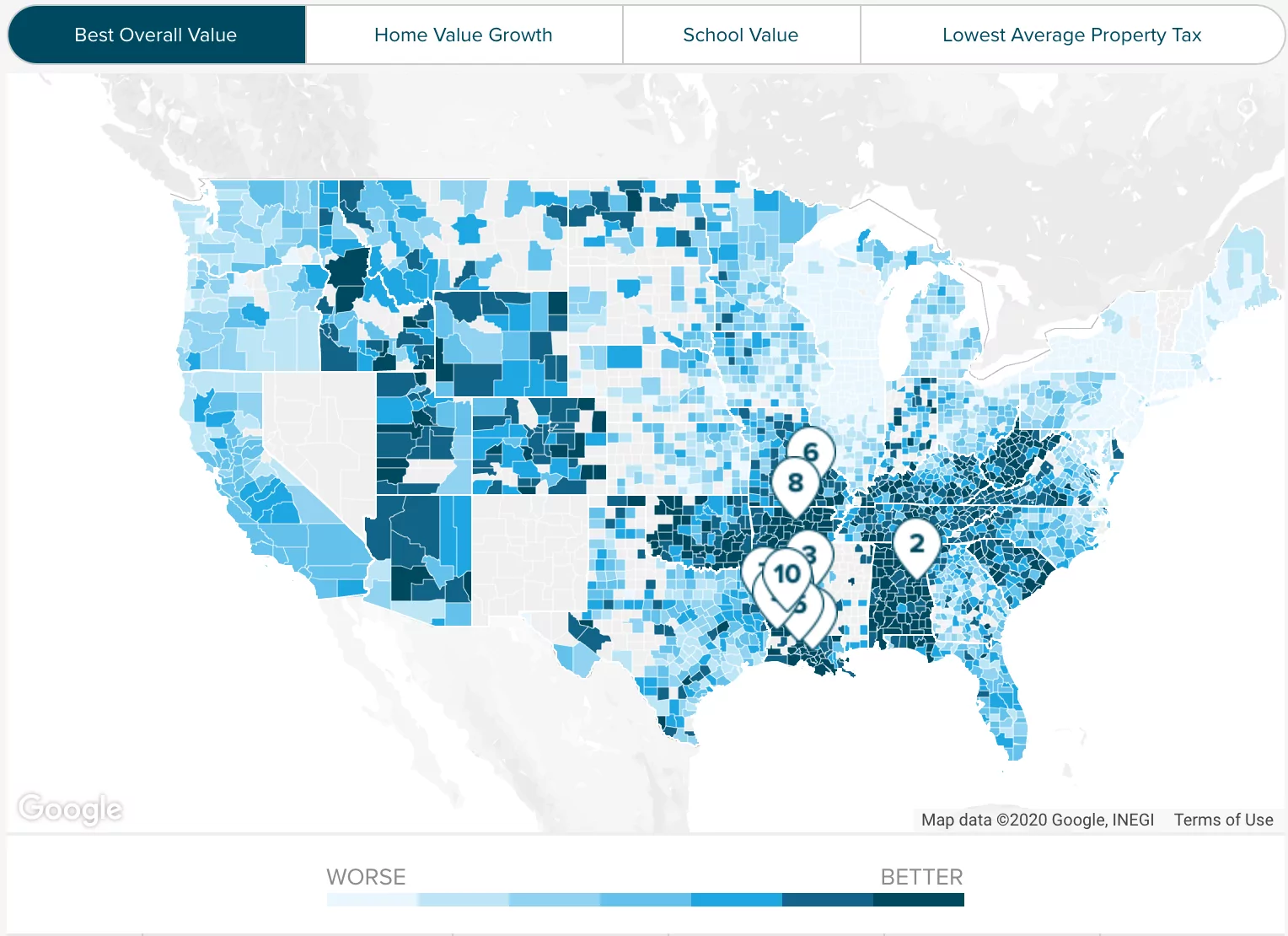

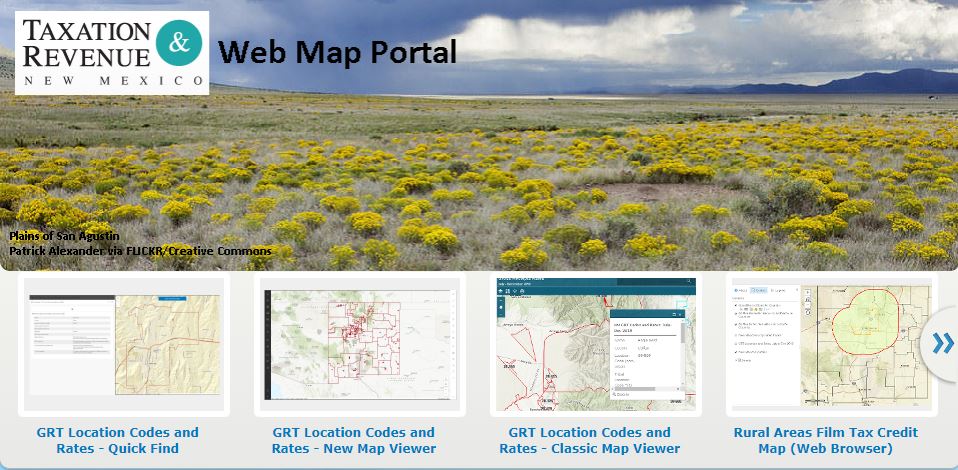

Gross Receipts Location Code And Tax Rate Map Governments

Sales Tax Rates In Major Cities Tax Data Tax Foundation

This Is The Most Expensive State In America According To Data Best Life

Illinois Sales Tax Rates By City County 2022

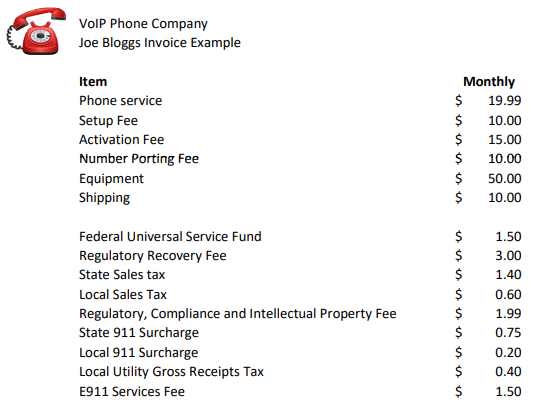

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

New Mexico Sales Tax Calculator Reverse Sales Dremployee

Louisiana Sales Tax Rates By City County 2022

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Wireless Taxes And Fees Climb Again In 2018 Tax Foundation Of Hawaii

Voip Pricing Taxes And Regulatory Fees Explained

Amazon In Its Prime Doubles Profits Pays 0 In Federal Income Taxes Itep

Gross Receipts Location Code And Tax Rate Map Governments